Whether during financial difficulty or emergencies, many individuals today seek loans for personal use and business purposes, to settle bills, and to cover expenses. Today, loans have fallen out of the exclusive reserve and responsibilities of banks. Many lending platforms and institutions have been born that offer quick and easy access to small and medium-size loans, instant payment, low annual interest rates, and adequate repayment time frame. These platforms are safe and reliable and operate with the easy access of a mobile app.

Read on to learn about 5 of the best loan apps in Nigeria today.

5 Best Loan Apps in Nigeria today

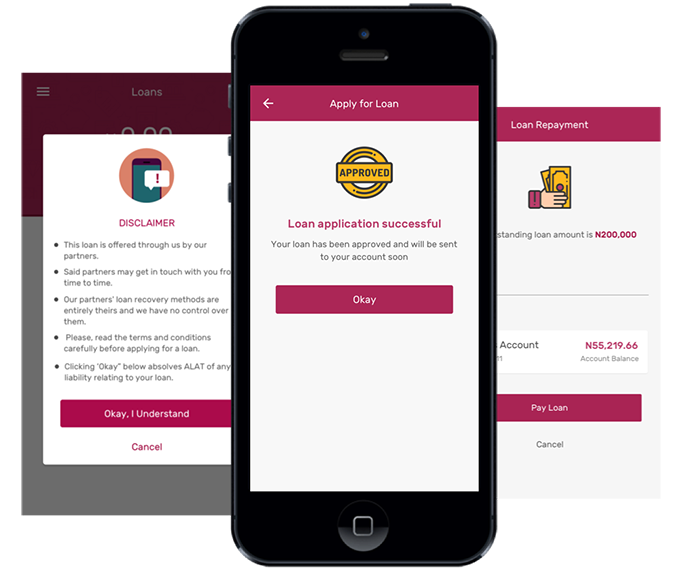

Nigeria’s first-ever fully digital bank is the first on this list of best loan apps in Nigeria. This is a simple, and entirely digital platform that grants quick and instant loans without any form of paperwork. ALAT does not require a visit to a physical location and the response time between loan acceptance and loan disbursement is in minutes.

All you have to do is

- Download the app from Play Store or App store,

- Register to open an account

- Click on the loan option from the menu.

- After you have completed all necessary documentation, an evaluation of your risk store will be conducted and a range of loan offers will be presented to you along with the applicable duration and interest rate.

- Once you click on your preferred loan offer and accept it, your account will be credited. With this platform, you can borrow as much as 2 million naira without collateral.

Alat loan also offers a range of services such as the Device-lending offer and the Goal-based loan which allows you to receive a loan towards a specific goal or towards getting your preferred device or gadget. The interest rate is also designed entirely to help the user. Salary earners can receive about 50,000 and even up to 4 million within hours and will have between 3 months to 24 months to pay back with only a 2% interest rate per month on a reducing balance basis.

- Carbon

Previously known as PayLater, this simple lending platform gives access to loans within minutes. It provides short-term loans that help you cover immediate expenses and emergencies. You can request and receive a loan effortlessly without any documentation. All that is required is your bank verification number (BVN) to ascertain loan credit. With this app, you can receive up to 20 Million with interest rates from 5% to 15%.

- Branch

Branch is another reliable loan app that allows you to receive up to N200,000 worth within 24 hours with a minimal amount of N1000. Repayment is within 4 to 40 weeks and the loan attracts varying interest rates depending on the amount of the loan and the user’s repayment history. No collateral or documentation is needed to access a loan with this platform – all you need is your phone number and bank verification number and you are good to go.

- PalmCredit

Borrowing from the PalmCredit app is easy and can be done in some quick minutes. It has a straightforward service that allows users of the app to have access to instant loans worth N2000 to N100,000 hassle. Individuals who will qualify for the loans must however be 18 years old and above. The app also offers rewards to users who refer others to the loan service.

- AellaCredit

AellaCredit focuses on employee lending and allows its users to receive quick loans with a monthly interest rate of 6% to 20% and requires loan repayment within 3 months. AellaCRedit also provides other financial services like investments, bill payments, and affordable insurance services.

How do I get on ALAT?

In case you are wondering how you can join ALAT, Simply Click here to download ALAT app for Android phones) and iPhone).