ALAT HUB

Welcome To The ALAT Hub…

The Inner Trybe created to promote financial inclusion and bank the unbanked one Agent at a time.

ALAT Hub is the Bank’s Financial Inclusion arm. It provides basic financial services such as Account opening, Deposits, Withdrawals, Fund transfers, Bill payment, airtime, Card request linking and activation, Micro-Savings and Micro-Savings Loan to the unbanked and underbanked in over 24,000 locations across Nigeria and in the Diaspora.

This service is provided by 3rd party individuals and businesses known as agents who act on behalf of ALAT.

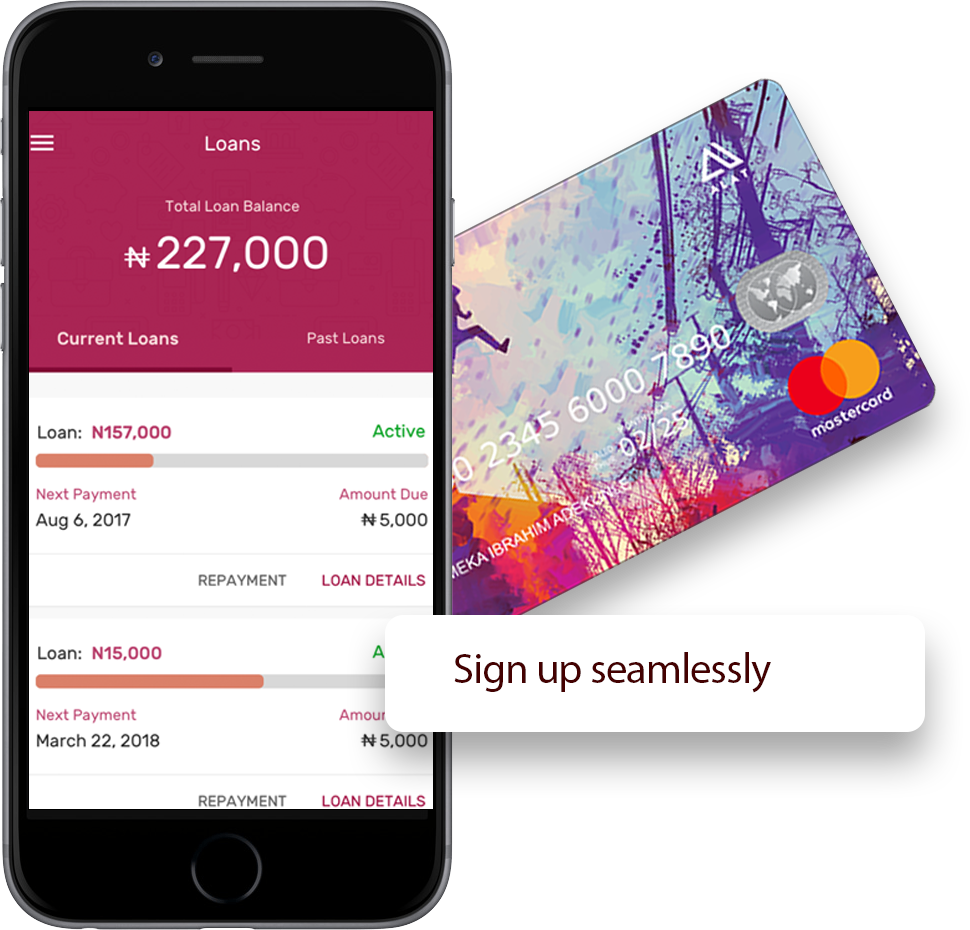

Sign up on ALAT HUB

Frequently Asked Questions

Alat Hub is the financial inclusion hub of Wema Bank via agency banking services. Agent banking is the provision of financial services to customers by a third party (agent) on behalf of a licensed deposit taking financial institution and/or mobile money operator (principal- Wema Bank).

Agent banking also refers to the delivery of financial services outside conventional bank branches, through 3rd Parties who often use non-bank retail outlets and rely on electronic solutions like Mobile Phones, specialized devices, point of sale terminals etc. to service customers on the go.

- An agent is an entity/individual that is engaged by a financial institution to provide specific financial services on its behalf using the agent’s premises across various locations.

- An agent can be a super-agent (A super-agent is a licensed agent contracted by the bank and thereafter may subcontract other agents in a network while retaining overall responsibility for the agency relationship) or a Sole agent (A Sole agent is an agent who does not delegate powers to other agents but assumes agency relationship/responsibility by himself.)

We seek or provide our customers with the opportunity to access financial products and services without having to visit any branch. It is also imperative that will take our place as a financial institution to play our part in the Financial Inclusion drive to include the unbanked, underbanked and underserved across various locations in Nigeria.

There is no difference between the Easylife opened by agents and that opened by on ALAT or our branches.

- Enhance financial inclusion

- Increase our brand visibility to customers

- Access to locations where there is still a huge percentage of the unbanked

- Align with the regulatory body’s push for the adoption of Agent Banking to breach the financial exclusion gap

- To offer full range of banking services to our customers without their having to visit a branch.

An individual well known in a community or registered business with a physical street address in a specific location, can consent to serve as the registered agent for agent banking. And upon successful application, vetting and approval, these Agents will be trained and authorized to offer selected products and services on behalf of the Bank.

.

We have taken every step possible to be sure that, every transaction carried out by the Agents are documented and meets the latest security standards, including using the foremost and most preferred financial inclusion application -BankPass and software in the industry.

Yes, you can perform your transactions at any Agent location, anytime of the day in as much as the agent is available.

- Account Opening

- Collection and submission of account opening and other related documentation

- Cash deposit and withdrawal.

- Funds transfer

- Airtime purchase

- Bills payment (utilities, taxes, tenement rates, subscription etc.

- Card issuance

- Micro Savings – Coming Soon

As soon as the customer links his/her BVN. If customer does not have BVN, then he/she must visit the branch for BVN enrolment. However, BVN enrollment will soon commence at agent locations

Yes. The existing upgrade procedure will apply

Yes. Wema bank agents can attend to any Wema Bank customer irrespective of the account type.

No. immediately the account has been opened by the agent, the system places the account on PND. The customer needs to attach his/her BVN to begin debit transactions by dialing *945*BVN#

- Maximum cumulative balance of N300,000

- Maximum single deposit limit of N50,000

- Maximum one-time or cumulative withdrawal limit of N30,000 per day through electronic channels

As much as the customer can afford, subject to minimum of N1,500 for debit card issuance